What’s investing?

Investing. Buying. Selling. We all know the language of investing from books, movies and television.

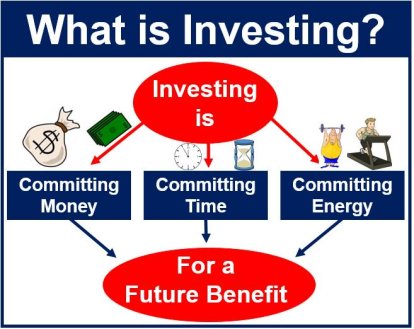

But what are people actually doing when they invest?

Never mind the buzzwords or the fast-talking financial news analysts. The world of investing is actually very straight forward and easy to grasp. You just have to start with the basics.

What is investing?

Investors expect to make money on their money, on a consistent basis.

When you invest in the stock market you are purchasing an asset, usually a stock. Stock represents ownership in a company. The public can buy individual shares, or units of stock, that represent a share of the company’s earnings and profits., a bond. Bonds are debt issued by a company, municipality, or government to raise funds. They pay interest at a predetermined rate. A bond purchaser is a lender, and the issuer is a borrower. , or a fund. A fund is a basket of stocks that can help investors diversify. In contrast to just one stock, a fund can help you spread out your investment risk.. When you purchase stock, you’re buying a small percentage of a company. When you purchase a bond, you are purchasing the debt of a company or a government. When you purchase a fund, you’re acquiring a bundle of stocks, bonds or cash, or potentially all three.

People buy stocks, bonds, and funds with the hope of earning more money on these investments than they would from putting that money in a savings account.

Why do people invest?

People invest for a lot of reasons.

Maybe you want to put money away for retirement. Or save for a down payment on a house. Perhaps you want to start a college fund for your child.

Or maybe you believe in the future of a company that produces innovative software or your favorite soft drink. Maybe you want your money to grow along with a sector’s (say healthcare or energy) profits.

Got an extra 2-3 hours per week? Want to start a lucrative business from home ? Want to boost you Credit too? Go—>Here

No investor is the same. Everyone’s goals are different. Here’s what all investors have in common: The hope of growing their money over time.

How is investing different than saving?

Investing and saving are both essential parts of a solid financial strategy. But they actually serve different purposes.

Savings means cash, the kind you keep in your checking or savings account. Savings are great for a “rainy day.” This could mean unexpected bills or a household emergency. It’s the money that’s there when you need it.

A good rule of thumb: Have enough savings to meet six months of expenses in case of an emergency.

Here’s the thing. The money in your checking or savings account may not earn you much interest. Most savings accounts offer pretty low rates these days.

In short, building your savings is critical to making sure you have cash ready, even though it’s not necessarily great for growing your money.

Go follow me on my other Social Media Accounts:

![]()

![]()

![]()

![]()