There are many different factors that go into your credit score, also known as FICO score. Your FICO score is calculated based on your credit report by a formula created by the Fair Isaac Corporation. However, FICO does not actually disclose its exact formula.

Though nobody knows exactly how important each factor is in calculating the credit score, one known factor that plays a large role is your utilization rate.

Though nobody knows exactly how important each factor is in calculating the credit score, one known factor that plays a large role is your utilization rate.

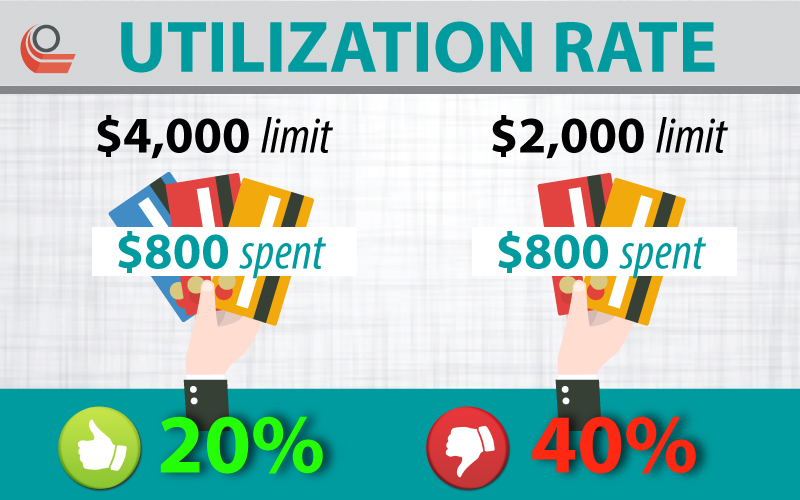

Your utilization rate is basically “how much of your available credit you are using?”

The theory is that if someone has credit lines of $10,000 and they’re using $9,500 of that credit, they’re a much greater credit risk than someone who’s only using $1,000. Therefore, their credit score would be lower.

However, there are a few things about the way FICO calculates your utilization rate that are a bit strange. One small loophole in particular can result in you being able to quickly boost your credit score without actually having to reduce your credit balances.

This guy has some interesting points too! Please consider them. The actual truth for you probably lies somewhere in the middle. Experiment and play around with it. Just stay within the parameters of the game.

==> The Odd Thing about Credit Utilization

Rather than measuring your average utilization rate, FICO chooses to measure your score based on your highest utilization rate.

For example, let’s say you have two credit cards. Both of them have a $5,000 limit. One card is maxed out, while another card has a balance of zero.

In this case, your maximum utilization rate would be 100%. In this case, your credit score will be severely negatively impacted.

On the other hand, if you had distributed your credit balance half and half over the cards, your maximum utilization would be only 50% each.

Another example would be if you had one card with a $1,000 limit and another card with a $5,000 limit. If you had to charge $800, it’s a much better idea to charge it to the $5,000 card.

How about adding a Tradeline account…to a debit card?

==> A Few More Things to Know about Utilization Rate

The ideal utilization rate is 20% or under on all your cards. Having even one card above 30% will drag your max utilization up.

In an independent study of 70,000 different credit scores, researchers found that people with 720 or higher credit scores tended to have utilization rates of 15% or less. However, people who had a zero percent utilization rate often had very low credit scores. That’s because their credit scores were so low, they couldn’t even get a credit card. The ideal is not to have a zero percent utilization rate. If you’re not using your credit cards at all, you’re not demonstrating creditworthiness. Remember – creditors want to know that you’ll pay off loans you take out, not that you don’t take out loans.

So try to get your utilization rate between 1% and 15%. If you have a low balance on one card and a high balance on the other, try balancing your cards out to get your maximum utilization rate down. This one technique can very quickly give you a credit boost, literally in just a few days.

Go follow me on my other Social Media Accounts:

![]()

![]()

![]()

![]()