Get immediate access to your local Dealer Auction – buy a car today!

Yes, I’m in Atlanta Georgia, but if you want Auction Access and deal with a local Licensed Dealer in the great state of Minnesota, get with me. You can make extra money flipping cars! ~All services provided by a local Dealer in (Anok, Minnesota).

The state you live in does not matter…. This Minnesota Dealer can provide you with access to your neighborhood Dealer Auctions.

-Think you can make money selling cars?

-Got a few extra hours a week?

-Got a couple of extra bucks to invest?

People will always want good quality cars, and you can be the supplier🤗 …

Click here for Full description about Auction Access and how you can make money with it… Got Questions ? send me an Email here

Only $1299 annual signup and $150 per car title.

–Good in all states. Wherever there is a Manheim/Adesa/etc…this Dealer can get you local and national access and will 2 day mail all necessary documents you need like title/bill of sale/etc.

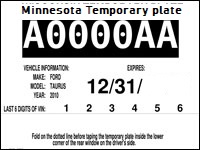

Includes a 21 day paper temp transport tag (out of state). If you are in the state of Minnesota you will receive a 31 day paper temp tag. You must provide proof of your own personal car insurance policy at initial signup with this Dealer. Dealer does not provide insurance at all.

-The Dealer gives you a temp tag for you to use responsibly. There is no Dealership insurance associated with these temp tags at all. All insurance is your responsibility.

So, to recap….you get a paper temp tag for each car you buy (included in your $150 per car doc fee). Each subsequent 21 or 31 day paper temp tag for that same vehicle…would be $50 each. So…in this scenario, you got 42 or 62 days worth of paper temp tags for just an additional $50.

Checklist of things we need to get you started (send to my 👉🏾 Secure Email address)

- -Copy of your Driver License

- -Copy of your personal policy Insurance card

- -Mailing address

- -Cellphone Number

- -Email Address

- -Social Security # (Auction Access requires this)

- -Signed Contract

Claim your Free Vacation when you sign-up today…

You can use Docusign to digitally sign the contract and return to me. Or you can print it off on paper, fill it out, take a picture and send to me.

Down load the app: android (google play store) or iphone (itunes app store)

Cash Deposit to Bank of America Acct.

$1299

GF Auto Consulting LLC: 3340 5025 0711

Or…..

Debit /Credit card incurs a 3% transaction fee by the bank ….($39).

Total is $1338 –>Payments page

Click orange “Pay Now” button and then enter $1338

(if you want to pay via PayPal, send me an email first because I have to prepare an official PayPal invoice for you -still an additional 3% transaction fee).

Go follow me on my other Social Media Accounts:

![]()

![]()

![]()

![]()